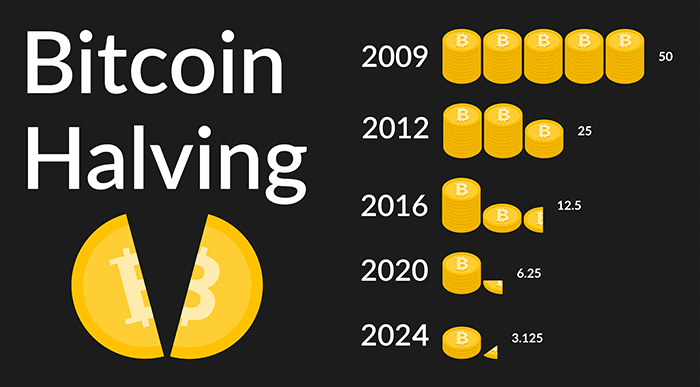

Bitcoin halving is a scheduled event where the reward for mining new blocks is reduced by 50%. It occurs approximately every four years and is part of Bitcoin’s design to control inflation and limit the total supply of Bitcoin to 21 million coins.

The next Bitcoin halving is expected to occur in April 2024. After the halving, the block reward will be reduced from 6.25 BTC to 3.125 BTC.

Bitcoin halvings are important events for the cryptocurrency market because they can have a significant impact on Bitcoin’s price. In the past, Bitcoin’s price has tended to rise in the lead-up to and after a halving. This is because halvings reduce the supply of new Bitcoin being released into the market, which can create upward pressure on prices.

However, it is important to note that Bitcoin’s price is volatile and can be affected by a number of factors, including supply and demand, news events, and investor sentiment. It is therefore impossible to predict with certainty how Bitcoin’s price will react to the next halving.

Here are some of the potential implications of the next Bitcoin halving:

- Reduced inflation: The halving will reduce the rate at which new Bitcoin is created, which will help to control inflation.

- Increased scarcity: The halving will also reduce the total supply of Bitcoin that is available on the market, which could make Bitcoin more scarce and valuable.

- Increased demand: If demand for Bitcoin remains strong, the halving could lead to an increase in Bitcoin’s price.

- Increased mining difficulty: As the block reward decreases, miners will need to earn more transaction fees in order to make a profit. This could lead to an increase in mining difficulty.

Overall, the next Bitcoin halving is a significant event that could have a major impact on the cryptocurrency market. It is important to stay informed about the latest developments and to monitor Bitcoin’s price carefully.